Sectoral Analysis – Consumer Electronics

The consumer electronics market consists of the total revenues generated through the sale of video, audio and games consoles. The video sector consists of televisions, video recorders (VCRs), DVD players/recorders, integrated television recorders, camcorders, digital cameras, set top boxes. The audio sector consists of audio home systems, CD-players/recorders, minidisks, radios, portable audio systems (MP3 players, minidisc players, CD players, personal stereo, and radios). Games consoles consist of all hand-held and plug-in consoles.

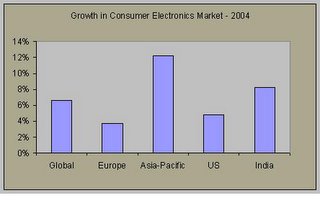

Global consumer electronics industry grew by 6.6% in 2004 to reach a value of $156.2 billion in 2004. As per the Datamonitor report Global consumer electronics market grew at a CAGR of 4.6% in 2000-04.

Chart 1

Global consumer electronics industry grew by 6.6% in 2004 to reach a value of $156.2 billion in 2004. As per the Datamonitor report Global consumer electronics market grew at a CAGR of 4.6% in 2000-04.

Chart 1

Source: Datamonitor Report (July 2005)

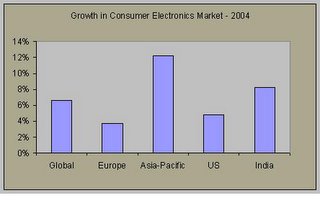

Indian consumer electronic market recovered in 2002-03. The market reached a value of Rs.129.5 billion in 2003 a growth of 12.4% over the previous year. In 2004 continuing the trend the market grew to Rs.154 billion approximately. Rising income levels, easy availability of consumer finance and declining prices of consumer electronics primarily drove growth. Decline in prices primarily being led by reduction in excise and custom duties and increased competition.

Chart 2

Indian consumer electronic market recovered in 2002-03. The market reached a value of Rs.129.5 billion in 2003 a growth of 12.4% over the previous year. In 2004 continuing the trend the market grew to Rs.154 billion approximately. Rising income levels, easy availability of consumer finance and declining prices of consumer electronics primarily drove growth. Decline in prices primarily being led by reduction in excise and custom duties and increased competition.

Chart 2

Source: Datamonitor Report (July 2005)

The second half of 1990s saw the first bunch of global brands like Akai, Aiwa, Sansui and Toshiba through strategic tie-ups with the established Indian players.

The second half of 1990s saw the first bunch of global brands like Akai, Aiwa, Sansui and Toshiba through strategic tie-ups with the established Indian players.

The other multinationals like Sony, LG, and Samsung entered on their own and quickly captured the imagination of the market with innovations in product quality and features. In order to gain market share the players invested heavily on marketing strategies and product innovations. As a result the sales realizations declined from 1999-2000. However, since then the focus of the players has been on creating differentiation through product innovations and aesthetic appeal.

With product innovations emerging as the key driver of growth, global players have invested significantly R&D. While product innovation is narrowing the margins it is contributing to growth in sales. A similar trend is being witnessed in Indian consumer electronics industry. Despite the low penetration the declining prices (primarily led by the reduction in excise and custom duties) of the consumer electronics have enticed the consumers to opt for products with better technology and attributes. For instance the sales of flat color televisions (CTVs) in 2004 accounted for 30% of the industry’s total sales, a growth of 120% over 003. This trend started in 2001 when price reductions as a marketing strategy took a back seat with players trying to differentiate premium models that were both technologically and aesthetically superior.

Rising raw material costs and energy costs has impacted the margins of the global consumer electronics industry. Plastic is a substantial input for the industry constituting 30% of the cost. The price of plastic has gone up considerably in the global market. However, reduction in custom duty on plastic to 10% in 2005-06 will help lower the plastic cost for the Indian manufacturers. Customs duty on color picture tubes and color and B/W TVs is reduced from 20.4% in 2004-05 to 15.3% in 2005-06. Current excise duty on color picture tubes is 16.3%.

Major Players – Consumer Electronics Industry (India)

Videocon International has a strong presence in the Indian market. The other key players in Indian consumer electronics market are LG Electronics, Samsung and MIRC Electronics. Videocon has recently acquired Thomson’s TV tube manufacturing business to become the only Indian manufacturer of these vital components. The domestic company BPL recently formed a partnership with Sanyo in the color TV sector. One reason for the current dominance of local players is India’s tariffs on imports. However, free trade agreements with Thailand and other Asian countries will be coming into force in the next few years. This liberalization will doubtless benefit those companies from China and elsewhere that are able to supply cheap imports.

Growth Prospects

50-75 million middle class Indians constitute who form the realistic consumer base of consumer electronics market is the key driver of demand for the industry. With Indian economy showing a robust growth, average monsoon, and lower inflation despite fuel price hikes is likely to result in increased spending on consumer electronics in 2005. In recent years the penetration level of the industry has increased in the rural markets especially for CTVs. This is expected to continue further.

Given the fact that consumer electronics is very price sensitive, reduction in prices by the players in the past have lead to increase in demand. Pricing of a product largely depends upon the cost of input, distribution, marketing and general industry scenario in the light of the competition. With inflationary rise of costs of input and increased marketing spend the margins for the industry would be under pressure. The demand for consumer electronics in India is also driven by sporting events like cricket world cup. Chart 2 shows the growth of the consumer electronics market in India. The spike in growth rate in 2003 was mainly due to the cricket world cup. With no such event in 2004, the growth rate dipped. As per Datamonitor forecasts the consumer electronics market is expected to grow at a CAGR of 7.7% for the five-year period 2004-2009.

The dominance of the local players in Indian consumer electronics would be challenged in few years when the free trade agreements with Asian countries comes into effect. Currently due to higher import tariffs the local players are enjoying a cost advantage. Cheap imports from these countries would definitely impact the cost structures of the local players. Additionally, the aggressive marketing and price wars by the multinational companies are the major risks for the domestic companies. This would entail the component suppliers to bring in their costs down. For instance in case of color picture tubes (CPTs) domestic production increased from 9 million units in 2003 to 12 million units in 2004. However, the sales value per unit of production declined from 18% in 2003 to 13% in 2004. Given the present scenario this is expected to fall further. Similar trend is being noticed for audio equipment also . With dominance of local players being challenged in the industry the local component suppliers may have to rethink their future course of action.

No comments:

Post a Comment